Post Payroll Data from Excel to Sage 200

This tutorial is part of a series of tutorials on Excel to Sage 200 integration using the popular Excel add-in: Excelerator.

In this tutorial, we’ll demonstrate how you can effortlessly prepare and post monthly payroll data into Sage 200 from Microsoft Excel. To see this live, book a free demo.

View a video of this tutorial here:

Prepare Payroll Data using our spreadsheet template

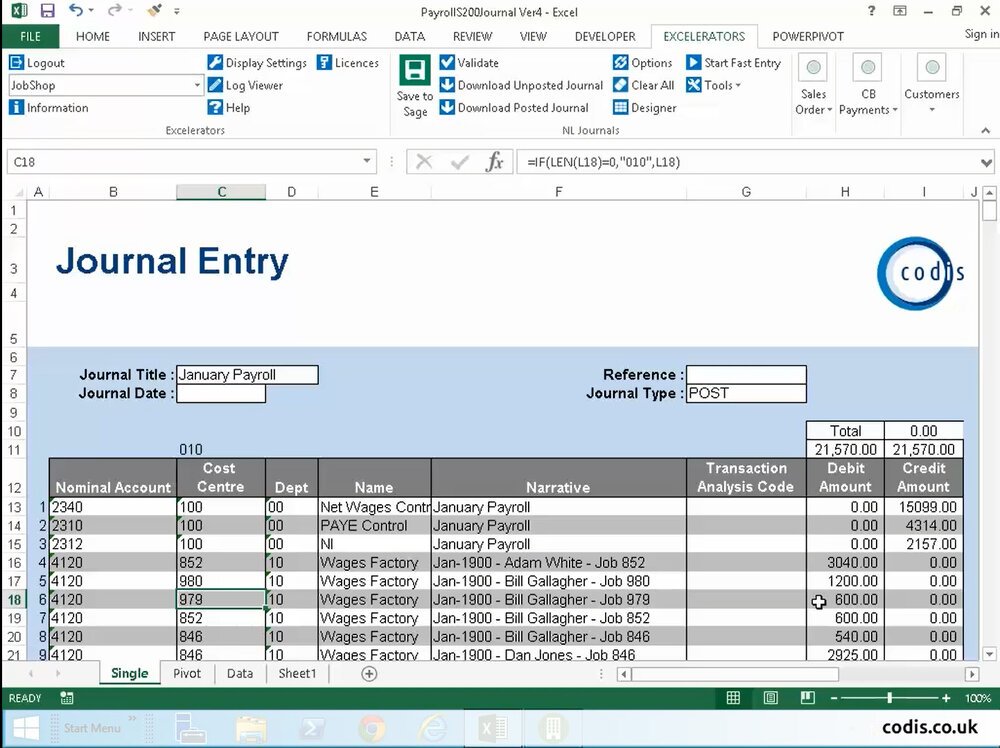

Open the payroll journals template. This is supplied with Excelerator. The template has no values but has embedded formulas which pulls the information into the journal.

The payroll data that comes from the third party system is of a standard format and typically contains Employee Number, Employee Name, Job Number, Date, Hours Worked and financial information for Gross, Net, PAYE and National Insurance.

We copy the information and paste into the data area of the template.

We can then summarise the data by Job Number and Employee Name using Excel’s Pivot Table functionality. All standard Excel functionality is available to you, such as formulae, graphs, flash fill, auto sums etc. We click refresh in the pivot table.

If we go back to our journal template, it has pulled in the information from the pivot table. The first three rows contain the control accounts. The narrative column contains the Job Number and Employee Name.

We can add the date.

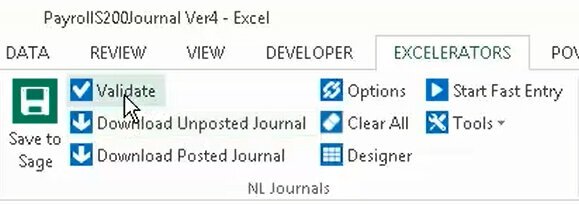

Click Validate to ensure the information is correct and consistent with Sage.

Click Save to Sage to import the data to Sage.

And there you have it, a quick and easy way to prepare monthly payroll data into Sage 200.

Where to go from here

Download the latest release of Excelerator now.

View Excelerator in action with our tutorials.

For help with Excelerator, check out our online Excelerator Help.

Contact us to find out more about this new update, see a demo, or learn about upgrades.